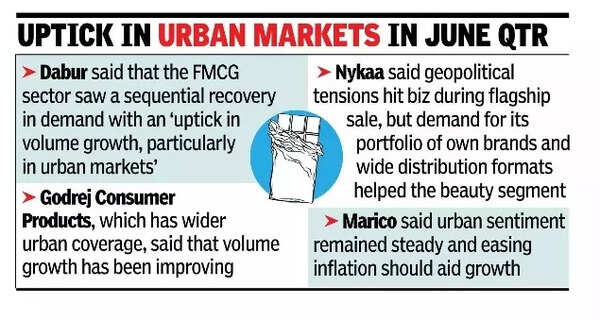

MUMBAI: Consumers spent on packaged goods, beauty, fashion, and jewellery in the June quarter, indicating some revival in demand that had been dragged down by sluggish urban consumption, even though early rains and geopolitical tensions capped growth, quarterly updates published by companies showed.Dabur said the FMCG sector saw a sequential recovery in demand with an “uptick in volume growth, particularly in urban markets”. Although the company’s home & personal care and health care segments are expected to deliver strong growth, the beverage portfolio was hit by a short summer and unseasonal rains. “On account of the decline in beverages, Dabur’s consolidated revenue is expected to grow in low-single digits,” the maker of Hajmola and Odonil said.Godrej Consumer Products, which has a wider urban coverage said that volume growth has been improving.

For Marico, which has been grappling with high copra prices, unseasonal rains “heightened” inflation in the commodity, keeping gross margins under pressure. The company, which captures a large share of the coconut oil category through brands such as Parachute, took nearly a 30% price hike in the segment over the past 12 months. Volumes in Parachute saw some decline during the quarter, but overall growth got a leg-up from foods and premium personal care categories. “…underlying volume growth in the India business continued to improve sequentially to reach a multi-quarter high, driven by positive trends in core franchises and continued scale-up of new businesses,” Marico said, adding that urban sentiment remained steady and easing inflation should aid growth in the coming quarters. Moderating palm oil prices and range-bound crude oil derivatives should translate into broader gains for companies from the second half of FY26.High inflation over the past few quarters pushed urban consumers to cut back on discretionary spending, pushing govt to provide tax incentives, the benefits of which started to kick in from the June quarter. Nykaa reported that geopolitical tensions led to some “loss of business” during the company’s flagship sale in Q1, but demand for its portfolio of own brands and wide distribution formats helped the beauty segment, which is expected to deliver gross merchandise value (or sales) growth in the higher mid-20s. The fashion business also fared better, the firm said. Tata Group’s retail business Trent, though, indicated a slower 20% growth in its standalone revenue for Q1, compared to its five-year CAGR of 35%, indicating that a full demand recovery is some time away.Wedding demand and Akshaya Tritiya sales boosted Kalyan Jewellers’ sales in Q1. “The recently concluded quarter was a very fulfilling one, recording consolidated revenue growth of 31%… despite multiple pauses in demand, majorly due to volatility in gold prices and geopolitical tensions,” the company said.