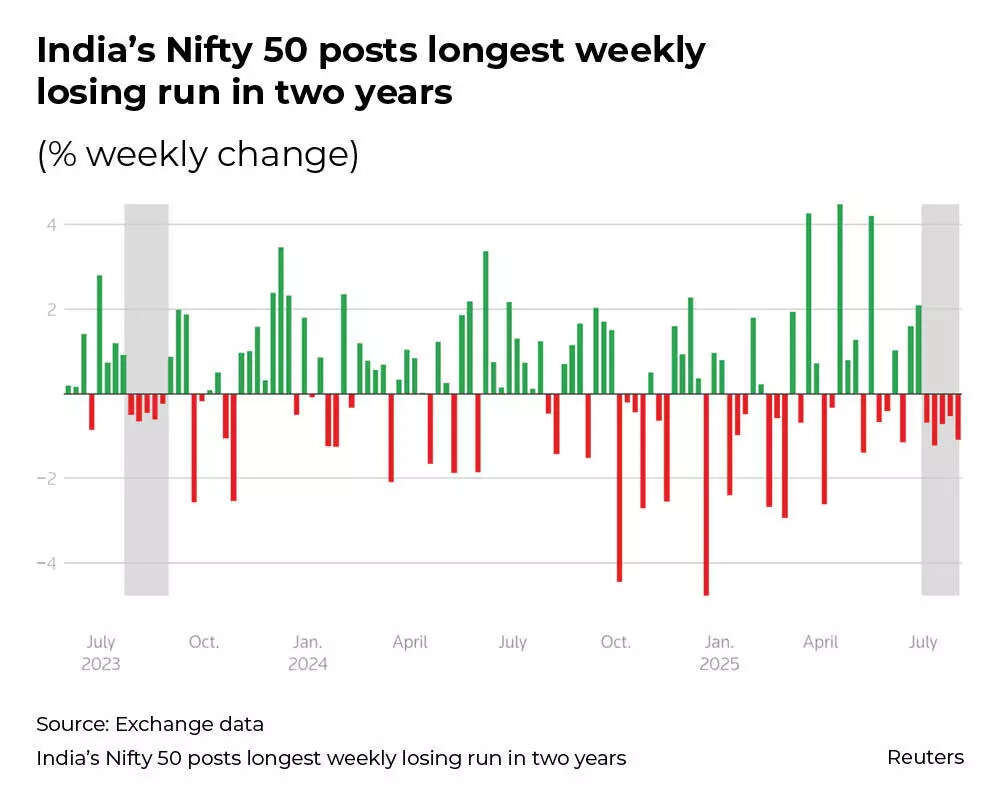

Indian stock markets indices, Nifty50 and BSE Sensex, ended the week down over 1%. In fact, the benchmark indices have seen their fifth consecutive week of closing in red. Nifty50 has dropped over 270 points this week, while BSE Sensex plunged over 860 points.“The benchmark index Nifty wrapped up its fifth consecutive week in the red — its longest losing streak since August 2023, raising eyebrows across the street. What adds to the concern is the back-to-back formation of bearish candles with long upper shadows on the weekly chart. This pattern is a classic sign of rejection at higher levels,” says Sudeep Shah, Head – Technical and Derivatives Research, SBI Securities.“Despite making multiple attempts to scale up, the index has struggled to hold ground, only to be met with selling pressure each time. The long upper wicks are a telling story — bulls tried, but bears had the final say. It reflects a market that’s finding it hard to build on gains, weighed down by renewed supply pressure and a cautious sentiment hovering overhead,” he added.

Nifty50 sees longest weekly losing streak in 2 years

The broader markets weren’t spared either. Both the Nifty Midcap and Nifty Small Cap 100 indices came under notable selling pressure and have now underperformed the frontline index for the second consecutive week.The Nifty Pharma index recorded a 3.3% decline on Friday, marking its third consecutive negative session and registering a weekly loss of 2.9%. Global pharmaceutical companies saw pressure following the White House’s directive to 17 international drug manufacturers asking for reduced prescription drug prices in the US to align with global standards.

Why is the Indian stock market falling?

What’s driving the bearish sentiment? According to SBI Securities, several factors have contributed to this shift in tone — from renewed concerns around the progress of India–US trade negotiations, to persistent FII outflows, and a string of underwhelming corporate earnings that failed to meet market expectations. 1) Unrelenting FII selloffForeign Institutional Investors (FIIs) continue their selling trend, with a substantial Rs 5,588.91 crore worth of shares sold on Thursday. FIIs have consistently sold Indian stocks during the past 9 trading sessions, with the selloff reaching Rs 27,000 crore.FIIs have established record bearish positions, with short positions in index futures reaching 90%, the highest level since March 2023. The long-to-short ratio declined to 0.11 at the August series commencement, whilst the Nifty rollover rate decreased to 75.71% in July from June’s 79.53%.“Investor sentiment weakened further as FIIs now hold the second-highest net short position in derivatives, reflecting elevated caution,” said Vinod Nair, Head of Research, Geojit Investments.The significant increase in the dollar index to 100 has further accelerated the FII selloff. “FIIs had been selling right through the month. So, they probably had an inkling that the BTA is not really going India’s way, and there were other factors around the FIIs selling, which was China looking very good from a valuation and a growth upgrade perspective. I think China’s growth is now projected to shoot up to 4.8,” market expert Sunil Subramaniam was quoted as saying in an ET report.2) Donald Trump’s 25% Tariff on IndiaMarket confidence deteriorated after US President Donald Trump signed an executive order that imposed a higher-than-anticipated 25% tariff on India. The prospect of additional penalty for India’s purchase of Russian oil and arms has also weighed on sentiment.“The Indian equity market extended its decline for a second day, pressured by renewed tariff threats and punitive duties that could undermine India’s global trade competitiveness,” said Nair of Geojit Investments.3) Underwhelming Q1 resultsIndia Inc’s first quarter earnings have seen muted and underwhelming results. Over the last 30 days, the IIT index has declined by 10%, whilst the Nifty Bank is flat. The combined performance of India’s leading nine private sector banks showed modest growth of 2.7%, indicating cautious economic expansion and subdued lending activity.4) Global Markets HitAsian markets saw big losses on Friday as traders evaluated new US tariff implications whilst awaiting US employment statistics. The MSCI Asia-Pacific index (excluding Japan) declined by 1.5%, seeing a weekly dip of approximately 2.7%.European shares displayed weakness, with the Stoxx 600 declining 1%, moving towards its poorest weekly performance since April.“Global equity markets were mostly weak over the past week, as the US tariff saga continued. The Indian equity market continued to underperform global equity markets in the past week,” Shrikant Chouhan, Head – Equity Research said.5) Strong US DollarThe US dollar index has seen a big 2.5% increase over the week, going beyond 100 and achieving its highest level in two months. This has been the dollar’s best week in approximately three years. The strengthening dollar has led to increased capital outflows from emerging economies, India included.(Disclaimer: Recommendations and views on the stock market and other asset classes given by experts are their own. These opinions do not represent the views of The Times of India)